Unlocking Success with Professional Tax and Accounting Services

Professional tax and accounting services are essential components of every thriving business. In today’s fast-paced economic environment, having a reliable partner to manage your financial obligations can make all the difference. This article explores the various facets of tax and accounting services, detailing their benefits and how they contribute to the sustainable growth of your business.

Understanding Professional Tax and Accounting Services

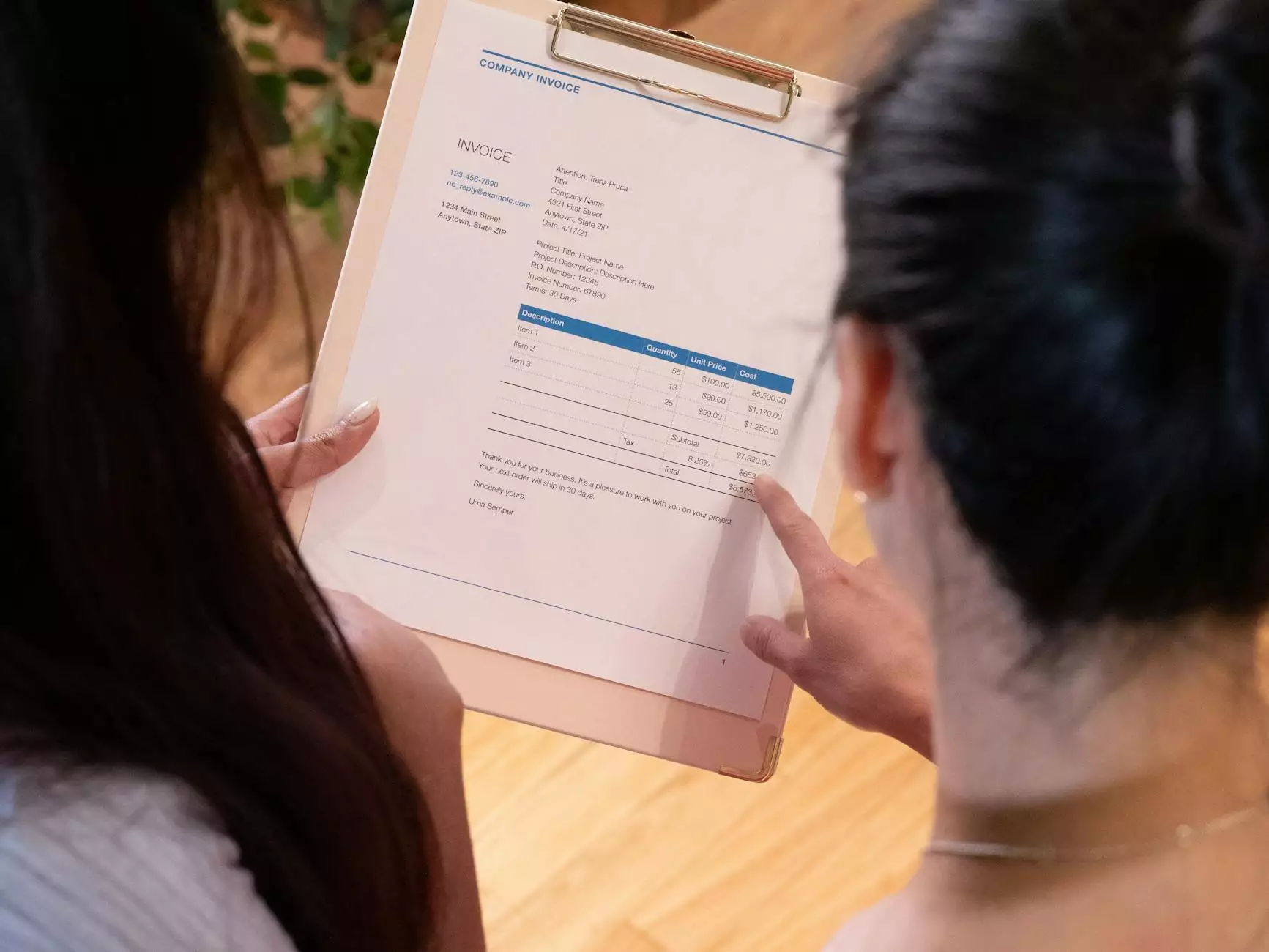

Professional tax and accounting services encompass a broad range of financial services designed to assist businesses in managing their finances effectively. These services include:

- Tax Preparation and Filing: Ensuring compliance with tax laws and regulations.

- Bookkeeping: Keeping accurate financial records that reflect the company’s operations.

- Financial Statement Preparation: Producing vital financial documents that assist in decision-making.

- Payroll Services: Managing employee compensation, benefits, and taxes.

- Consulting Services: Offering strategic advice for financial growth and risk management.

The Importance of Tax Compliance

One of the primary roles of professional tax and accounting services is to ensure tax compliance. Compliance with tax laws is non-negotiable; failing to comply can lead to severe consequences, including penalties and legal issues. Here are key reasons why tax compliance is vital:

- Avoiding Penalties: The IRS and other regulatory bodies enforce heavy penalties for non-compliance. Professional services help you avoid these costs.

- Maximizing Deductions: Knowledgeable accountants ensure that you take advantage of all eligible deductions, minimizing your tax burden.

- Audit Support: Should your business face an audit, having a professional accountant by your side can streamline the process and provide necessary documentation.

Streamlining Business Operations

Another significant benefit of engaging in professional tax and accounting services is their ability to streamline your business operations. Accurate financial data is essential for making informed business decisions. Here’s how these services can enhance your operational efficiency:

- Enhanced Financial Insights: Detailed reports from accountants help you gauge your business's financial health.

- Time Savings: Business owners can focus on core activities while professionals handle tax and accounting.

- Budgeting and Forecasting Assistance: With expert advice, you can create realistic budgets and financial forecasts.

Choosing the Right Tax and Accounting Partner

Choosing the right professional tax and accounting service can be overwhelming but is crucial for your business's success. Below are factors to consider during your selection process:

- Experience and Expertise: Investigate the firm's background and areas of specialization.

- Reviews and References: Look for client testimonials and seek out references.

- Technology Utilization: A modern firm should use up-to-date software for efficiency and accuracy.

- Communication Skills: Your accountant should be able to explain complex tax laws in simple terms.

The Cost-Effectiveness of Professional Services

While hiring professional tax and accounting services incurs costs, it can lead to significant savings in the long run. Here’s how investing in these services can be cost-effective:

- Reduced Tax Liabilities: Professionals can identify tax-saving opportunities, ultimately saving you money.

- Minimized Errors: Accurate financial reporting reduces the likelihood of costly mistakes.

- Informed Financial Decisions: Good advisory leads to better investments and resource allocation.

Industry-Specific Accounting Services

Different industries have unique accounting and tax requirements. Professional tax and accounting services can customize their offerings based on industry-specific needs. For example, a healthcare provider may face different financial regulations compared to a retail business. Here are a few industry examples:

- Healthcare: Regulation compliance, patient billing, and insurance reimbursements.

- Construction: Job costing and progress billing are vital in managing project finances.

- Retail: Inventory accounting and sales tax compliance are key focus areas.

Benefits of Ongoing Financial Planning

Engaging in ongoing financial planning with professional tax and accounting services offers numerous advantages. Businesses can benefit by:

- Adapting to Changing Laws: Tax laws frequently change, and professional accountants keep your business compliant.

- Strategic Growth Planning: Regular analysis can reveal growth opportunities and market trends.

- Risk Management: Identifying potential financial risks early allows for timely intervention.

Conclusion: A Strategic Investment

In conclusion, professional tax and accounting services are not just an expense; they are a strategic investment in your business's future. By leveraging the expertise of accounting professionals, you can ensure compliance, streamline operations, reduce costs, and ultimately drive growth. Embracing these services will position your business for success in a competitive landscape.

Contact Us

If you’re ready to enhance your business with excellent accounting services, contact us at taxaccountantidm.com. Our experienced professionals are here to provide tailored solutions that meet your unique financial needs.